How churches can use accounting software to track donations, expenses, and budgets with ease

Church accounting software simplifies donations, expenses, and budgets. Learn how the right tools save time, reduce errors, and build trust.

Managing church finances isn’t always simple. Many pastors, finance teams, and even volunteers know the struggle: days spent wrangling spreadsheets, sorting receipts, or trying to reconcile bank accounts after a busy ministry season.

Yet stewardship requires accuracy. Congregations trust their leaders to use funds wisely, and leaders want to make sure every dollar supports their mission. The right tools can make this less of a burden.

Why church finances are different

Church accounting looks different from business accounting. Instead of focusing only on profit and loss, churches must track designated gifts, ministry funds, and contributions earmarked for specific projects. A few common challenges include:

- Fund restrictions: Donations often come with a purpose, such as youth ministry, building funds, or missions

- Multiple income streams: Beyond weekly tithes, churches may receive grants, gifts in kind, or even stock and crypto contributions

- Volunteers and small staff: Many churches rely on part-time bookkeepers or volunteers, not professional accountants

With these complexities, trying to manage everything with Excel or paper ledgers often leads to errors, lost time, and unnecessary stress.

What church accounting software does

Church accounting software is built specifically for faith-based organizations. It helps churches:

- Track income and contributions accurately

- Manage expenses across different ministries and projects

- Generate clear reports for leadership, boards, and members

- Stay compliant with IRS rules by producing contribution statements

While standard accounting tools can track dollars, they aren’t designed to handle the nuances of funds, pledges, or donor transparency. That’s where church-specific solutions shine.

Tracking donations with confidence

One of the greatest benefits of accounting software is simplifying donation management. With integrated giving solutions like Pushpay, gifts given online, by text, through a church app, or even via stock or ACH are automatically recorded in the correct fund.

No more manual entry. No more worrying about losing track of contributions. At year’s end, churches can easily generate IRS-compliant giving statements for every household. That means less admin work for staff and greater transparency for givers.

Managing expenses and budgets

Churches aren’t just tracking donations—they’re stewarding expenses. Accounting software connects giving to ministry spending, making it easier to:

- Set annual or quarterly budgets for different ministries

- Monitor spending against projected giving

- Track project-based costs like mission trips, building campaigns, or community outreach

- Spot potential overspending early with real-time reports

Instead of waiting until year-end, leaders can make mid-course adjustments to protect financial health and steward resources wisely.

Reports and analytics that build trust

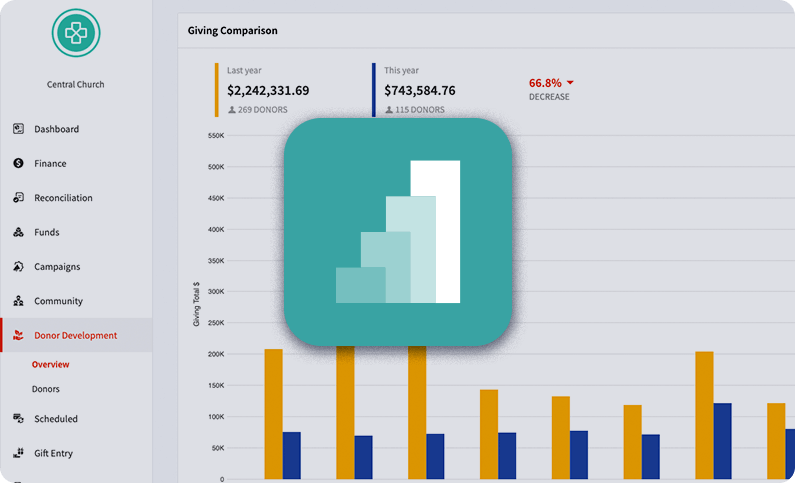

Transparency builds confidence. With church accounting software, leaders can generate reports that are easy for staff, boards, and even congregations to understand. Pushpay Insights, for example, brings giving and engagement data together in one view, helping churches spot trends, track generosity, and identify new opportunities.

Regular reporting not only makes audits and elder meetings smoother—it strengthens the congregation’s trust that resources are being managed faithfully.

The small church advantage

Some leaders assume advanced financial tools are only for large churches, but small congregations often benefit even more. For volunteers and bivocational pastors, software removes hours of manual work and reduces errors. And because solutions like ChurchStaq scale with need, churches don’t have to worry about outgrowing their systems.

Choosing the right church accounting software

Not every solution fits every church. When evaluating software, look for features like:

- Fund accounting to handle restricted gifts

- Donation tracking across cash, card, ACH, stock, and more

- Easy-to-generate contribution statements

- Integrations with your church management system (ChMS) and giving platform

- Simple, intuitive dashboards that volunteers and non-accountants can use

Having the right features in place ensures the software works for your church—not the other way around.

Stewardship made simple

Managing church finances doesn’t have to be overwhelming. With church accounting software, leaders can stop worrying about spreadsheets and start focusing on ministry. From tracking donations and expenses to building budgets and producing reports, the right tool brings clarity, confidence, and ease.

Faithful stewardship is about more than balancing the books—it’s about equipping your church to fulfill its mission. With modern accounting software built for churches, you can simplify financial management and spend more time serving people.

FAQs

What makes church accounting software different from business accounting software?

Business accounting software is designed for profit and loss, while church accounting software is designed for fund accounting—tracking donations, designated gifts, and ministry-specific expenses.

Can small churches benefit from using accounting software?

Yes. Small churches often rely on volunteers or part-time staff, and software saves them hours of manual work. It also reduces errors and helps ensure transparency.

Does church accounting software integrate with giving platforms?

Most modern solutions integrate with digital giving platforms like Pushpay. This ensures donations given online, via text, or through an app are automatically recorded in the right fund.

Can the software help with IRS compliance?

Yes. Church accounting software makes it easy to generate IRS-compliant giving statements at year-end saving administrators time and ensuring donors have proper records.

How does software improve transparency for the congregation?

By generating accurate reports and tracking expenses in real-time, churches can provide clear financial updates to boards, staff, and congregations. Transparency strengthens trust and stewardship.

What features should we prioritize when choosing software?

Look for fund accounting, donation tracking, expense management, budgeting tools, contribution statements, integrations with your ChMS, and ease of use for non-accountants.

Is church accounting software secure?

Yes. Leading platforms like ChurchStaq and ParishStaq are PCI-DSS Compliant, with strong safeguards in place to protect donor and financial data.