2 Simple Ways to Record Non-Cash Gifts at Your Church

In the Old Testament, tithing didn’t start off with a portion of someone’s bi-weekly paycheck. The Israelites gave coins, as well as sheep shearings, grain, olive oil, figs, pomegranate, other fruits, and a modge-podge of other valuable items.

Fast-forward to today. Giving has become mostly synonymous with financial sacrifice.

But people are still encouraged to give non-cash items to resource their churches. While the Israelites didn’t have to think about tax breaks for their ministry, your church does. And recording non-cash gifts can be tricky, messy, and extremely time-consuming even when done well.

Here are the two non-cash giving features in the Pushpay giving platform that makes recording other gifts easy and fast for your staff.

Non-cash giving

Sometimes non-cash gifts come at unexpected times for your church. Maybe you haven’t talked about non-cash giving for several months before someone moves to a new country and donates a vehicle, building supplies, or even a small building to your ministry. What now?

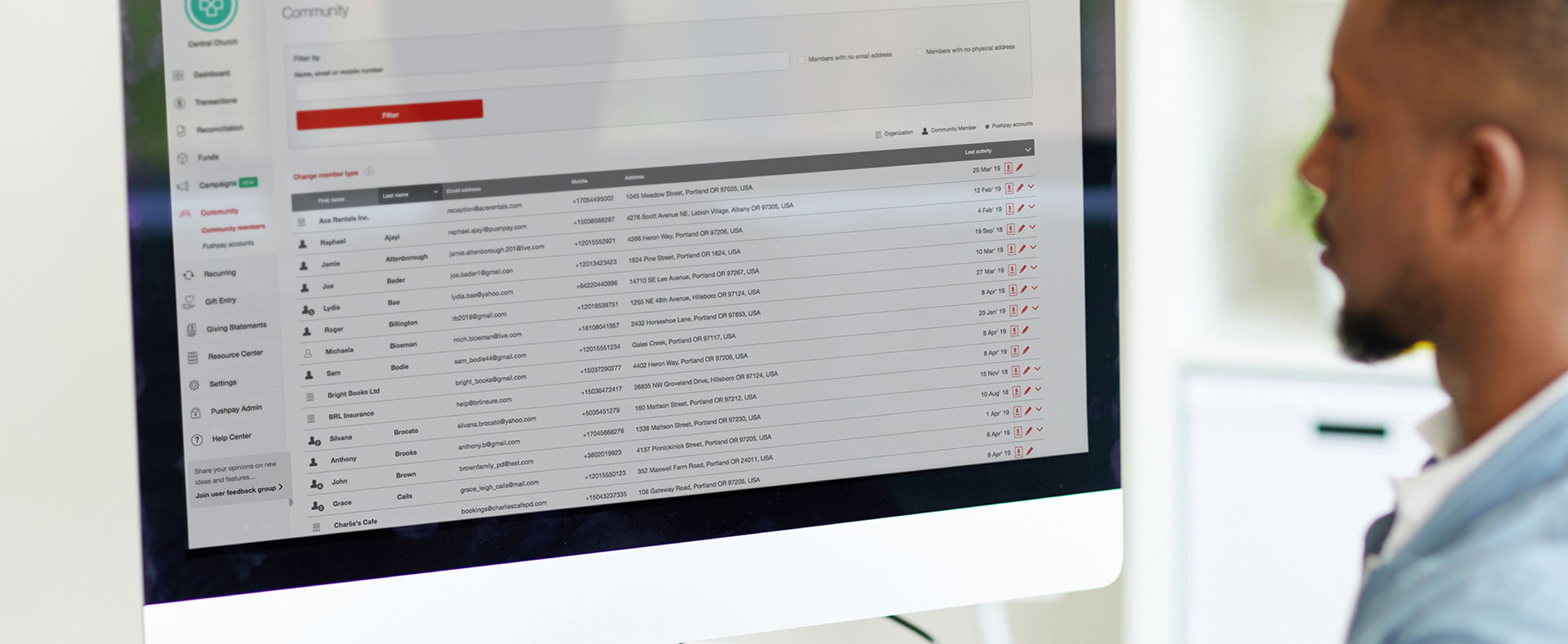

Instead of recording those donations in a ledger somewhere or sending the documents around in an email thread, non-cash giving in the Pushpay platform was designed to be an easy and effective way for churches to record those gifts.

Churches can now record gifts of all types and view these donations in a single place. This helps simplify record-keeping and makes sure all donations are properly accounted for. The last thing your church wants to happen is information about a huge gift getting lost in the shuffle. It happens from time to time and sinks your staff in a time-consuming chase for information. This new feature was created to solve this problem for churches moving forward.

Organizational Giving

Similar to non-cash donations, churches sometimes receive donations from local businesses. This isn’t new for ministries. Often, local small companies chip in to fund or staff a church’s fundraising campaign as part of their charity work in the community.

This is another side of generosity that helps keep churches thriving and empowered to keep serving their neighborhoods.

On the church staff side, these organizational gifts can be difficult to record or gets accounted for inconsistently, even though they’re typically cash gifts. Organizational giving is a new feature in the Pushpay platform designed to help churches more accurately record these gifts. The feature can recognize organizations, filter transactions, and generate giving statements for organizational donations, making Pushpay the single source of truth for all giving.

Non-cash giving, including organizational giving, isn’t new for the church. But the requirements for modern-day ministries in handling donations are relatively recent. These features were built to take the burden off staff in accounting for these resources and make it easier to find and reconcile gifts when tax time rolls around.

To discover how else the Pushpay platform serves as the single place of record for all donations at your ministry, take a few minutes to talk to one of our experts today!

Featured Content

You May Also Like