Quick Steps: Get CARES Act Assistance for Your Church

The $349 billion relief package under the CARES Act is here! Learn how to act fast to receive the assistance your church needs.

The last few months have been an incredible time for churches—navigating change, leading with love, and delivering a message of hope for those seeking clarity in this unprecedented time. We have seen a digital transformation for many and have been inspired by the creativity of pastors and congregations across the world. Fellowship and connection are not confined within the four walls of the church, and that has never been more apparent than it is today.

However, churches across the nation are battling their own reality as COVID-19 continues to impact operations. Many have already been faced with layoffs or have made the tough decision to furlough staff. At the beginning of this pandemic, the President signed into action the “Coronavirus Aid, Relief, and Economic Security Act” or the CARES Act. This relief package has helped small businesses and churches across the U.S. According to Newsweek, religious organizations received at least $7.3 billion in Payment Protection Program (PPP) loans.

As of December 28, 2020, Congress approved a $900 billion COVID-19 relief package as part of the Consolidated Appropriations Act, 2021 (The Relief Act). Included in that amount is $284 billion for a second round of the PPP. The great news is, churches once again qualify for assistance under the CARE Act’s Paycheck Protection Program!

We want to help you take advantage of this opportunity so your church can get the assistance it needs to continue ministry programs. Below are some resources, and a link to a step-by-step checklist to help you prepare immediately so you can receive loan assistance as quickly as possible. Know that the below information and guidance is current as of December 30, 2020.

Research the Paycheck Protection Program for Churches

Before you start the process, take a look at the below resources to help you quickly understand this second round of the Paycheck Protection Program in more detail.

Church Eligibility for the Paycheck Protection Program

So how can you discover if your church is eligible for this Paycheck Protection Program? Here are a few things to keep in mind as you get started:

- The second round of PPP loans are available to first-time qualified borrowers and borrowers that have previously received a PPP loan.

- Loans are limited to businesses that employ no more than 300 employees.

- Loans are limited to businesses that have used the entire amount of their first PPP loan or will use such amounts.

- Loans are limited to businesses facing significant revenue declines in any 2020 quarter compared to the same quarter in 2019.

- Borrowers must also be aware that this second round of PPP did not remove or change the necessity requirements.

Note: Additional eligibility requirements will be provided from the Small Business Association approximately 10 days after the bill is signed into law by the President.

How Your Church Can Use the Paycheck Protection Program Funds

If approved for the PPP Loan, your church can use the funds for the following:

- Payroll, rent, covered mortgage interest, and utilities

- Payments for church software or cloud services that facilitates church operations, the processing, payment or tracking of payroll expenses, and billing functions

- Costs related to church property damage, vandalism, or looting due to the public disturbances that occurred in 2020

- Expenditures to a supplier of goods that are essential to the operations of your church

- Operating or capital expenditures that allow you to comply with requirements or guidance issued by the CDC, HHS, OSHA, or any state local government.

Head to The National Law Review for more in-depth guidelines on how your church could use these funds.

PPP Round One vs PPP Round Two – The Differences

- The maximum loan amount has been reduced from $10 million in the first round to $2 million.

- In this second round of PPP, borrowers are able to choose the length of their covered period, with the minimum being eight weeks and the maximum length being 24 weeks.

- The second Paycheck Protection Program loan is calculated based on 2.5 months worth of payroll.

You can learn more about the differences here: Paycheck Protection Program Round Two

Consult legal and financial counsel

Connect with your legal counsel and financial advisors to determine the CARES Act’s applicability to your organization and confirm the right steps to ensure your application and documentation are prepared correctly. If you do not have legal or financial support on retainer, reach out to your congregation to see if anyone in your community is a lawyer and can provide assistance. Other options to explore are The Church Lawyers or the Alliance Defending Freedom, Church Alliance.

Collect Documentation in Advance

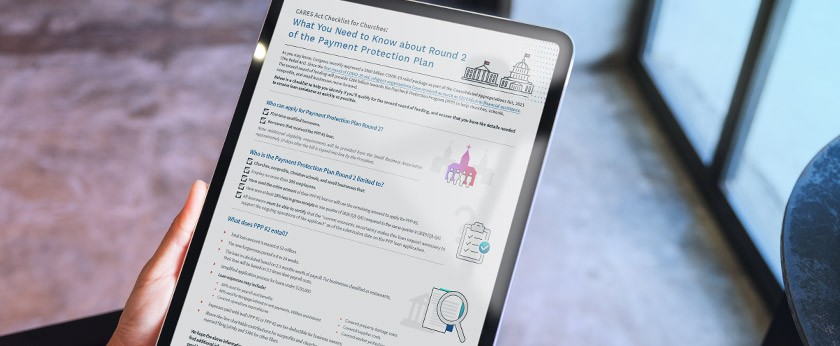

If you haven’t done so already, we recommend starting a spreadsheet. View an example from Vanderbloemen on how to build a spreadsheet. You will need to include payroll costs for the preceding 12 months prior to the date on which the loan is made. Separate these out month-by-month. For a full breakdown of other items to include, download the CARES Act checklist.

For more in-depth information: Download the CARES Act Checklist for Churches

We hope this information has been valuable for you as you look further into the Paycheck Protection Program. Keep an eye out for additional information as we continue the conversation and provide additional resources to help your team during the COVID-19 pandemic and beyond.