Features to look for in church finance tools

Discover the essential features of church accounting software, from fund accounting and donor tracking to payroll and budgeting tools.

Managing church finances isn’t the same as running a business. While businesses focus on profit and loss, churches are entrusted with designated gifts, donor contributions, and ministry-specific budgets that require a different level of care. A healthy financial system can help to build trust with donors and free staff from administrative headaches.

That’s why the tools you choose matter. The right church finance solution will streamline bookkeeping, simplify compliance, and give leaders the clarity they need to steward resources well.

Fund accounting built for ministries

At the heart of church bookkeeping is fund tracking. Unlike traditional accounting that centers on profit margins, fund tracking makes sure designated gifts and ministry budgets remain separate. That means the youth camp fund, building project, and missions budget all stay in their proper lanes.

Without clear fund tracking, churches risk misusing restricted gifts—often unintentionally. Pushpay helps prevent these errors by ensuring every dollar is tracked according to donor intent. Leaders gain peace of mind knowing they can give accurate updates to elder boards, pastors, and donors at any time.

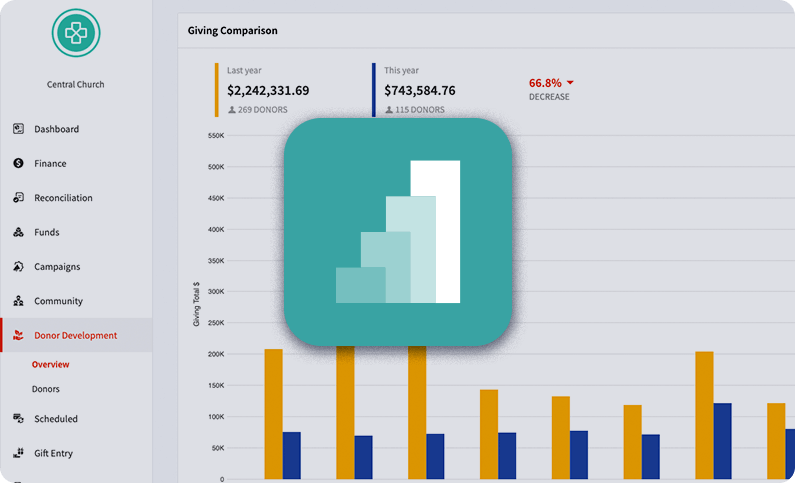

Detailed and customizable reporting

Pastors, boards, and finance teams all need clear insights into church generosity to make wise decisions. The best systems provide reporting that’s both detailed and customizable, giving every leader the level of clarity they need.

With Pushpay, leaders can generate IRS-compliant donor statements, review fund and campaign reports, and access real-time giving and engagement dashboards in Pushpay Insights. These reports are easy to share, which means pastors can communicate financial updates transparently with their congregation.

Donor and contribution tracking

Generosity is the heartbeat of ministry, and without reliable giving, churches can’t fulfill their calling. Donor and contribution tracking should be at the core of any church finance platform.

With Pushpay Giving, contributions flow seamlessly into your system. Funds are automatically assigned to the right ministry or project, whether for missions, a building campaign, or the general budget. Receipts are generated promptly, and year-end donor statements are produced with just a few clicks. Online and recurring gifts are integrated in real time, so staff never have to reconcile them manually.

For donors, this transparency builds trust. For staff and volunteers, it eliminates hours of manual entry. And for leaders, it creates a clear picture of church finances, making it easier to steward generosity faithfully.

Budgeting tools for ministries

Budgets are more than numbers on a spreadsheet—they’re a reflection of a church’s priorities. Every ministry, from children’s ministry and worship to missions and outreach, depends on thoughtful financial planning. That’s why strong budgeting visibility is a must-have in any church bookkeeping software.

Pushpay Insights provides leaders with a clear, real-time view of financial health. Ministry-specific giving trends can be tracked and compared to plan, eliminating year-end surprises. Pastors and ministry leaders can see how their generosity data aligns with church priorities without needing an accounting background, thanks to easy-to-read dashboards and visual reporting.

This kind of clarity not only reduces stress but also empowers leaders to make decisions that keep ministries healthy and aligned with mission. When financial information is easy to access and understand, it stops being a burden and becomes a tool for ministry growth.

Ease of use for staff and volunteers

Not every church has a full-time accountant. Many rely on part-time staff or faithful volunteers to manage finances. That’s why a user-friendly interface is critical.

Pushpay is designed with people in mind, not just finance experts. Role-based permissions ensure that pastors can see reports, bookkeepers can manage entries, and staff can input information without getting overwhelmed by unnecessary features. Cloud access means multiple users can collaborate from different locations, and simple workflows make training fast and stress-free.

When software is easy to learn and use, your team can spend less time on admin and more time focusing on ministry.

Integrations with church software and giving platforms

Church finances don’t exist in a vacuum. Contributions, donor data, and member management are all connected, and the best systems integrate these elements into one streamlined flow.

Pushpay offers more than 80 integrations, along with a robust API, to sync with accounting platforms, donor engagement tools, and member management systems. This reduces duplicate data entry, cuts down on errors, and keeps everything in sync across your church’s financial and ministry operations.

Compliance and audit readiness

Transparency matters. Churches are accountable to their members, donors, and in many cases, the IRS. The right system keeps your records audit-ready with detailed ledgers, contribution receipts, and grant reporting.

Pushpay provides IRS-compliant donor statements and PCI-DSS Level 1 security, giving churches confidence when facing audits or financial reviews. With clean, accessible records, leaders can demonstrate to donors and boards that every dollar is being stewarded responsibly.

Choosing the right church finance solution

Churches don’t need generic business tools. They need finance and giving software built for faith-based organizations, designed to simplify reporting, track funds, and empower ministry leaders.

Pushpay was built with those needs in mind. From donor contribution tracking to real-time engagement dashboards, from detailed reporting to role-based permissions, Pushpay equips churches to steward generosity faithfully. The result is more time for ministry, less stress for staff and volunteers, and greater trust with your congregation.

When your church chooses the right solution, you’re not just adopting a financial tool—you’re embracing a ministry partner. Pushpay helps your church simplify finances so you can focus on what matters most: serving people, strengthening connection, and advancing the mission God has given you.

FAQ

What is church accounting software?

Church accounting software is designed specifically for the unique financial needs of churches and ministries. Unlike generic accounting programs, it supports fund tracking, donor contribution reporting, and ministry-specific budgeting so that churches can manage designated funds, staff payroll through external systems, and compliance requirements with ease.

Why do churches need fund accounting?

Fund accounting allows churches to separate and track designated gifts, such as missions, building projects, or youth ministry funds. This ensures money is used according to donor intent and provides transparency for boards and congregations. Without fund accounting, churches risk mismanaging restricted funds.

Can church accounting software integrate with giving platforms?

Yes. The best church finance solutions integrate directly with giving platforms, donor management systems, and even accounting software. Pushpay, for example, connects online and recurring giving with fund tracking, ensuring contributions are tracked automatically and donor statements are generated seamlessly.

Is church accounting software only for large churches?

No. Churches of all sizes benefit from software that simplifies reporting, donor tracking, and budgeting. Smaller churches often rely on part-time staff or volunteers, and user-friendly church finance software ensures they can manage finances without needing professional accounting expertise.

How does Pushpay support church finances?

Pushpay provides integrated tools for giving, donor tracking, reporting, insights dashboards, and broad integrations with accounting platforms. By connecting financial data with ministry tools, Pushpay helps churches save time, reduce errors, and build trust with donors and congregations—all while keeping leaders focused on ministry.