Ever felt like your church budget is more of a mystery novel than a financial plan? One month the cash flow looks solid, the next you’re staring at the numbers wondering how you’ll stretch the funds to cover ministry, utilities, and that stubborn copier that only jams on Sunday mornings?

You’re not alone. Managing church finances is one of the top stress points for pastors and church leaders.

It goes beyond numbers on a spreadsheet. You’re stewarding the gifts of your congregation, protecting your church’s mission, and keeping ministry leaders resourced without burning out your finance team.

The good news? With a few practical habits, your church can move from financial stress to financial stability. Let’s walk through some best practices that make budgeting and financial management more doable (and maybe even a little less stressful).

1. Build a budget that actually works

When you sit down to create your budget, start with the mission. Every line item should connect back to your church’s purpose. If an expense doesn’t fuel the things you care about: discipleship, outreach, or the day-to-day health of your congregation, it’s worth asking whether it belongs in the plan.

The best budgets aren’t built in isolation. Invite your finance committee, treasurer, and ministry leaders into the conversation. They see needs, opportunities, and challenges from different angles, and their input can keep the budget realistic.

As you look at income, study giving trends over the past few years and pay attention to seasonal patterns. Plan with wisdom and prayer.

And once your budget is drafted, communicate it openly. Sharing highlights with your congregation builds trust and helps church members understand how their giving moves the mission forward.

A comprehensive solution for secure, cheerful giving & donor development.

2. Protect your church’s finances with strong practices

Think of financial safeguards as the seatbelts and guardrails of ministry. They may not be exciting, but they’re what keeps everyone safe on the journey.

That means putting internal controls in place, like requiring two signatures for checks or separating duties between those who count offerings and those who deposit them. It also means keeping your financial reports up to date.

Monthly church financial reports shouldn’t be optional—they’re the early-warning system that helps your church finance committee or church treasurer spot challenges before they become crises.

Don’t forget about assets, either. Monitor debt closely, set aside reserves for emergencies, and keep property and insurance policies current.

And when it comes to giving records, accuracy is paramount. IRS-compliant contribution statements are both a legal requirement and a way to honor the trust donors place in you.

3. Make financial administration ministry-friendly

The goal of church financial management is to free your staff for ministry, not bury them in reconciliation. If your team spends hours reconciling donations across multiple platforms, it’s time to rethink systems.

Platforms like Pushpay’s ChurchStaq centralize giving, reporting, and church financial statements, which means fewer spreadsheets and more time for people-focused work.

Good financial administration also gives leaders clarity. Simple, easy-to-read reports can help pastors make wise decisions without needing to be accountants. And with accurate data, you can plan ahead for major events, ministry expansions, or building projects instead of scrambling when the bills arrive.

4. Encourage generosity and make giving simple

Generosity is the lifeblood of church finances, but too often, complicated giving systems discourage participation. Make it simple. Offer people multiple ways to give—whether that’s online, through text-to-give, recurring donations, or even stock and crypto gifts.

Options are helpful, and culture matters more. Celebrate generosity by thanking donors often and sharing stories of the impact their gifts are making. Help people see that their giving isn’t about keeping lights on—it’s about advancing the mission of Jesus Christ through the life of your church.

And finally, encourage consistency. Recurring gifts provide stable income so your local church can plan with confidence, not guesswork. For church members, it turns generosity into a regular rhythm, not just a response to a special appeal.

5. Use technology to see the bigger picture

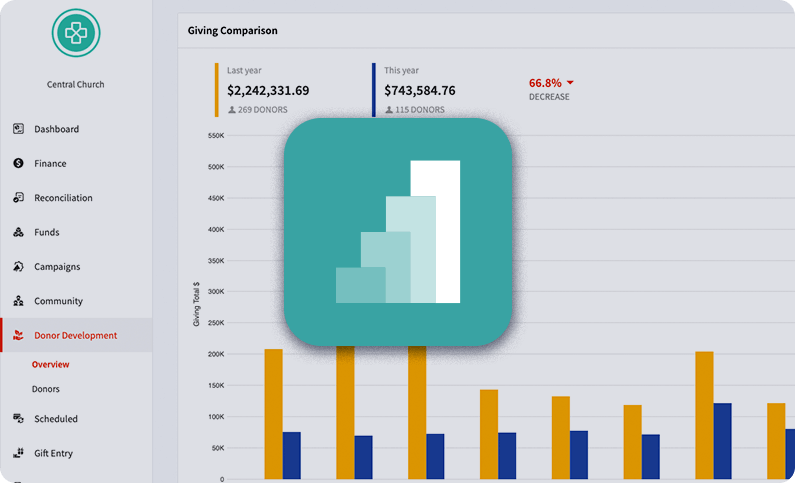

Financial dashboards shouldn’t require hours of analysis just to understand the basics. With Pushpay Insights, your team sees giving and engagement in one view, so leaders can spot trends, plan confidently, and make timely decisions.

Everygift protects at-risk donations and streamlines recurring giving, which steadies cash flow throughout the year. And with donor development tools, you’ll know who’s new, who’s repeating, and who may be slipping—so you can pastor people toward healthy financial stewardship rather than guessing.

When technology pulls data together, your finance committee moves from firefighting to planning.

6. Learn from other churches’ financial journeys

These practices aren’t theory; churches are living them out. When Heart Revolution Church in San Diego faced a leadership change and COVID, they lost nearly half their donors overnight. The financial stress was real.

Instead of shutting doors, their leaders leaned on Pushpay’s digital giving platform as the “backbone” of their financial operations. Every donation became easier to track, giving data revealed where engagement was slipping, and modern giving options connected younger families entering the community.

Today they’re feeding thousands, funding missions, and supporting families in need. Their finance director summed it up: “All the tools facilitate every donation that we receive as a church, but also provide ways to make it personal and measurable.” That’s stewardship paired with smart tools.

7. Commit to financial integrity

Trust is the true currency of ministry. Clear policies, consistent processes, and open communication protect your church’s finances and your people’s confidence. Schedule periodic reviews or audits, publish simple summaries of how church funds are used, and apply the same standards across ministries and campuses.

-

- Accountability: Regular reviews and open reporting reduce risk and model integrity.

- Leadership: When pastors and boards practice transparent stewardship, the congregation follows.

Integrity builds confidence, and confidence builds generosity.

Your church can thrive financially

Budgeting and financial management may never be the most glamorous part of ministry, but it’s one of the most important. With a clear budget, strong practices, simple giving tools, and a commitment to integrity, your church can protect its resources and fuel its mission.

You don’t need to be a financial expert to succeed—have a plan, a team, and the right tools for effective church financial management. And remember: every decision you make about church finances is ultimately about advancing the mission God has given your congregation.

Take a deep breath, gather your finance committee, and know that with wisdom and stewardship, your church’s financial future is in good hands.

FAQs

Why is budgeting important for churches?

Budgeting ensures that every dollar is aligned with your church’s mission, supports ministries effectively, and builds transparency with your congregation.

How can a church improve financial accountability?

Churches can strengthen accountability by using internal controls, requiring multiple signatures for expenses, publishing regular financial reports, and scheduling audits or reviews.

What tools can help with church financial management?

Church management platforms like Pushpay’s ChurchStaq streamline giving, reporting, and donor engagement, saving time and increasing clarity for leaders.

How do churches encourage consistent giving?

Consistency can be fostered by offering recurring giving options, providing multiple giving methods (online, text, stock, crypto), and celebrating generosity through impact stories.

What role does technology play in church finances?

Technology provides real-time dashboards, donor insights, and automated reporting, helping leaders spot trends, reduce administrative burden, and plan confidently.

How can churches build financial trust with members?

Financial trust grows when churches practice transparency—communicating clearly about budgets, publishing summaries, honoring donor intent, and committing to financial integrity.